Resources

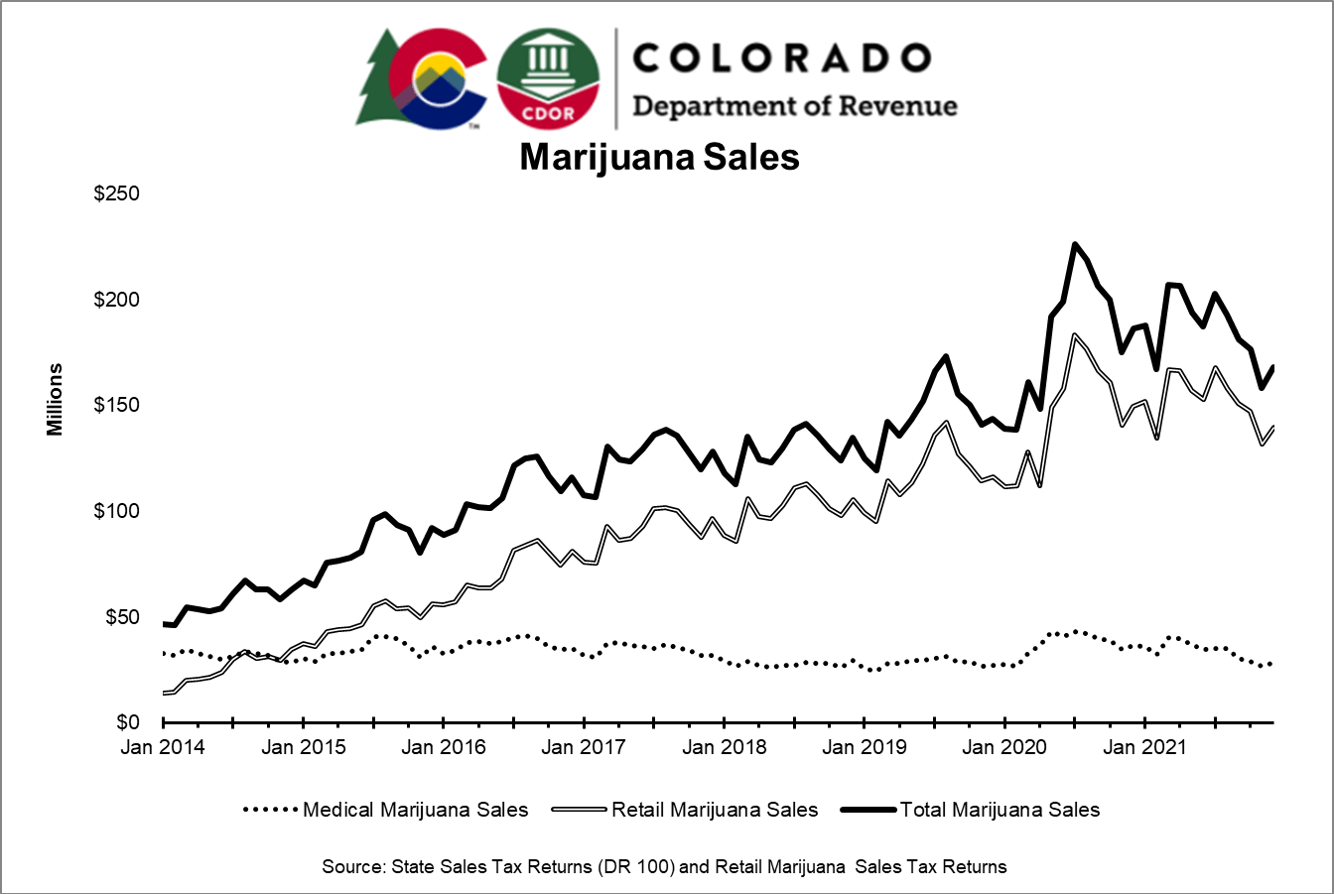

Colorado state tax revenue from the legal cannabis industry surpassed $2 billion in January and the state has collected more than $88.7 million in fees.

In addition to state and local taxes and fees, cannabis businesses have an effective federal tax rate of about 70% – compared to about 26% for other businesses.

Did you know Colorado legal cannabis dispensary owners are unable to deduct normal business expenses like payroll and rent from their federal income taxes?

Marijuana has contributed over $320 Million dollars to Building Excellent Schools Today (B.E.S.T.), making up about 25% of the program's entire budget.

In FY 21-22 alone, nearly $15.3 million in state cannabis dollars went to state Affordable Housing Grant and Loans.

The Marijuana Tax Cash Fund collected $188.8 Million in FY 2021-22 alone.

In FY 21-22 alone, nearly $15 million in cannabis dollars went to the School Health Professional Grant program.

More than $15 million in cannabis dollars went to substance abuse treatment in FY 21-22.

More than $1.6 million cannabis dollars went to the Tony Grampsas Youth Services Program in FY 21-22.

Voters in 59 of 64 Colorado counties voted no on Proposition 119 sending a clear message against raising taxes on cannabis consumers.

Unlike other legalized substances, the marijuana industry has a 97% compliance rate for unauthorized sales.

Unlike alcohol, research has proven you can only get “so high.” Cannabinoid receptors in your brain eventually prevent the body from getting further intoxicated.

Did you know? Since legalization in 2005, teen use in Colorado has remained flat and is below the national average.

According to a recent poll by the Pew Research Center, more than 90% of Americans think cannabis use should be legal.

Did you know? MIG represents more than 400 cannabis business licenses across the state.

A 2021 study found that medical cannabis use was associated with clinical improvements in pain, function, and quality of life with reductions in prescription drug use.

Founded in 2010, MIG is the oldest and largest trade association for licensed cannabis businesses.

Colorado’s marijuana model has become the example for all other regulated cannabis states, and MIG works directly with policy makers to ensure that Colorado’s program is fair, tightly regulated, safe, and successful.

Safe Sales: Every marijuana sale in CO takes place on camera and requires multiple ID checks.

All regulated marijuana in Colorado is tracked from “seed to sale,” with oversight from the Marijuana Enforcement Division.

Established in 2010, MIG has led legislation for child resistant packaging, customer safety resources, and purchase restrictions for 18-20 year olds.

Marijuana is taxed at both state and local levels. This year Aurora built a new $34 Million dollar rec center, fully funded by local marijuana taxes.

The marijuana industry suffers from unfair Federal tax rules, which means that MIG members’ effective tax rates are around 71%.

A 2019 study showed that crime does not increase with legalization.

Conditions for medical marijuana

Cancer - Glaucoma - HIV or AIDS - Cachexia - Persistent muscle spasms - Seizures - Severe nausea - Any condition for which a physician could prescribe an opioid - Autism Spectrum Disorder - Severe pain - PTSD

Most marijuana businesses have access to banks, but because marijuana is still federally illegal, businesses are unable to access merchant processing services such as VISA or Mastercard.

Consuming higher potency marijuana does not lead to higher levels of impairment.

-- Journal of the American Medical Association (JAMA) 2020

71% of Colorado voters favor marijuana legalization. This has increased 10 points in the last four years alone.

MIG Statement on CO Cannabis Revenue Topping $2 Billion for Schools, Mental Health, Public Safety and More

MIG Press Release

FOR IMMEDIATE RELEASE

DATE: Monday, January 17th, 2022

CONTACT: Erin McCann

303-746-2365

MIG Statement on CO Cannabis Revenue Topping $2 Billion for Schools, Mental Health, Public Safety and More

Industry has Officially Generated more than $2 Billion in Taxes and Fees for State

DENVER – The Marijuana Industry Group (MIG) is spotlighting a recent filing released by the Marijuana Enforcement Division indicating that Colorado state tax revenue from the legal cannabis industry has surpassed $2 Billion. This is more than $2 Billion in taxes and fees that has been used to construct and repair schools, support mental health and addiction programs, and fund public safety, health care resources, education, and countless other programs that benefit families across the state. According to Colorado’s Dept of Public Health & the Environment’s Healthy Kids Survey, since legalization, there have been no significant changes in youth cannabis use.

“Our members value the ability to play such a large role in improving our state and contributing to causes like public education, mental health care, public safety, youth prevention, and more,” said Tiffany Goldman, MIG Board Chair. “Our focus as an industry moving forward, however, will be ensuring that these dollars are being spent effectively on causes Coloradans care about, not pet projects or special interests. The truth is, due to a broken federal system and other challenging regulations, the industry is struggling. We want to make sure that money is also being reinvested in our local cannabis businesses to ensure we can continue generating this critical funding for years to come.”

To collect this revenue, the state imposes a 15% excise tax which is imposed when any marijuana is transferred out of a cultivation facility and is paid by the cultivator. The state then imposes a 15% sales tax on recreational marijuana sales and the regular 2.9% sales tax on medical marijuana which is paid by the consumer.. Most localities have additional local taxes on marijuana. For example, in addition to the normal Denver sales tax rate of 5.91%, the city charges an additional 5.5% on all recreational marijuana.

These taxes do not even consider dated and burdensome federal tax laws that put the effective federal tax rate for legal cannabis businesses at around 70%. When compared with a similarly sized small business taxed at 26%, it’s clear that cannabis companies pay much more than their fair share of taxes.

A large chunk of cannabis dollars go back into our public school system. 100% of excise tax funding beginning in 2022 goes to the B.E.S.T. Public School Capital Construction Assistance Fund to build brand new schools across the state and make critical repairs in existing schools. Marijuana has contributed over $320 Million dollars to B.E.S.T., making up about 25% of the program's entire budget. The B.E.S.T program has made improvements in 525 schools in nearly every school district across Colorado.

Of the money that comes from the 15% recreation sales tax, 10% is returned back to localities that have opted into legal cannabis. Of the other 90% of this, about 12% goes to public schools, about 15% is retained in the general fund, and the remainder of this funding goes into the Marijuana Tax Cash Fund. All of the medical sales tax funding goes to the Marijuana Tax Cash Fund.

The Marijuana Tax Cash Fund has to be used for priorities Coloradans care about such as health care, health education, mental health and substance abuse prevention and treatment programs, and law enforcement. State legislators determine how this money is allocated.

The Marijuana Tax Cash Fund collected $188.8 million in FY 2021-22 alone. Below are just a few of the projects in FY 2021-2022:

- Affordable Housing Grants and Loans: $15.3 Million

- School Health Professional Grant Program: Nearly $15 million

- Community Prevention and Treatment Program: More than $1 million

- Mental Health Services for Juvenile and Adult Offenders: More than $4.5 Million

- Increasing Access to Effective Substance Abuse Disorder Service: More than $15 Million

- Colorado Veterans Service to Career Pilot Program: $500,000

- Juvenile Diversion Programs: $400,000

- Enhance School Safety Incident Response Grant Program: $250,000

- Tony Grampsas Youth Services Program: More than $1.6 Million

###

Images